Announcement: Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec et quam blandit odio sodales pharetra.

The big shift is happening in favour of passive funds

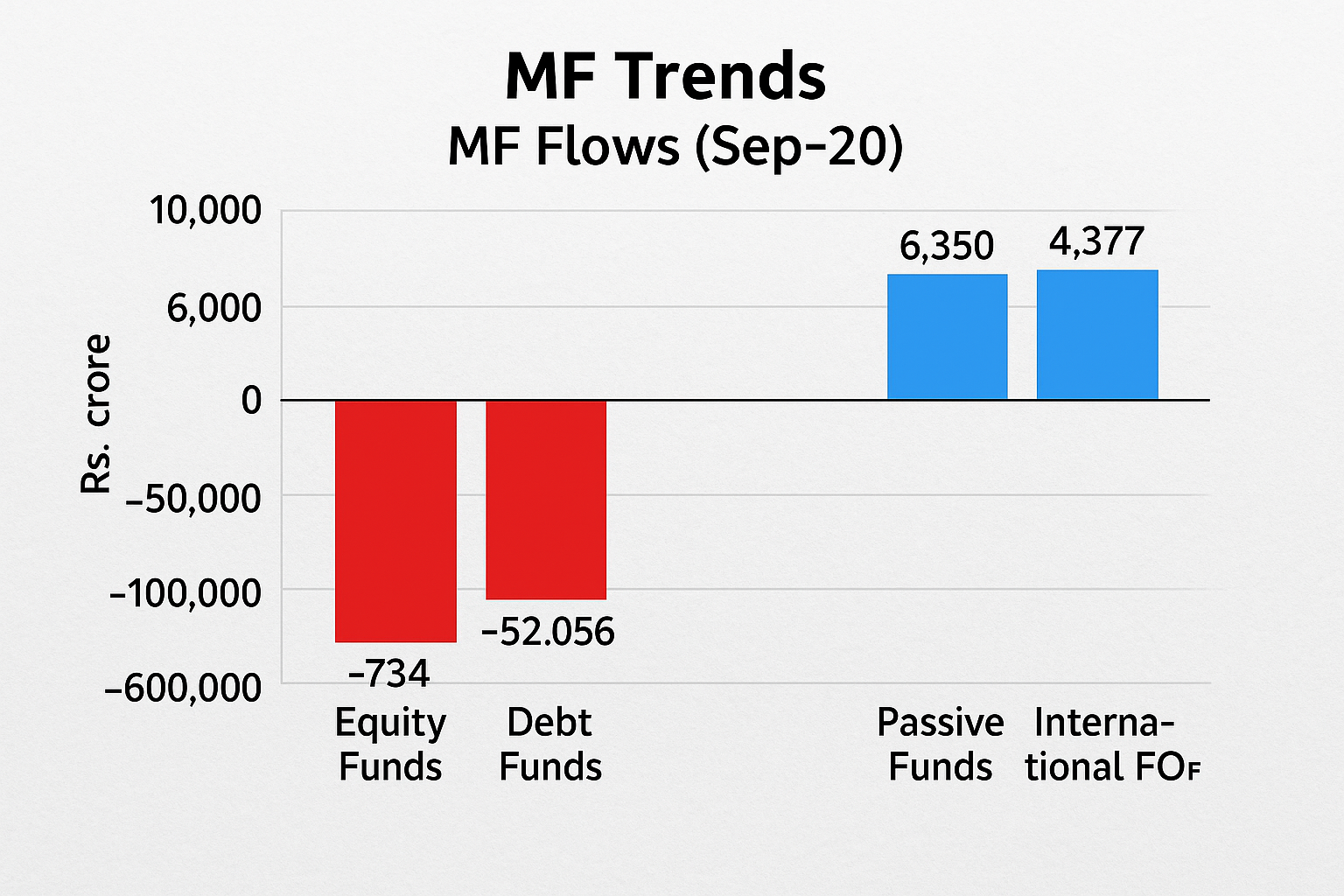

The mutual fund flow data put out by AMFI for the month of September has shown some interesting trends. The MF AUM overall has come down in Sep-20 compared to Aug-20. That is largely attributed to debt fund outflows and the sharp correction in equity markets in the last week of September. Here are some key takeaways for the various mutual fund categories in terms of MF flows.

Table of Content

Equity funds and SIPs struggle

For the third month in a row, the equity funds saw net outflows. Of course, at Rs.734 crore in Sep-20, the outflows were not as bad as Rs.4000 crore in Aug-20 or Rs.2480 crore in Jul-20. But the fact is that the slowdown in equity fund flows is surely taking its toll on the ability of mutual funds to infuse money into the equity markets. If you look at the equity fund flows, the major outflow is from multi-cap funds, largely on the back of regulatory uncertainty. Focused funds and small cap funds are seeing interest as the game shifts to Alpha. The more interesting trend is on the SIP front. SIP flows are below Rs.8000 crore for the fourth month in succession; but robust nevertheless. What it indicates is that, if you cancel out the SIP impact, then lump-sum selling in equity funds has actually been quite rampant. For the time being, it is the huge surge in new and young investors that is, probably, keeping the equity funds flows ticking. That seems to be the trend for now.

Debt fund outflows

Debt funds saw outflows to the tune of more than Rs.52,000 crore. But that is largely understandable. September is the end of the second quarter of the fiscal year and there is a lot of pressure on companies and institutions to handle liquidity due to outflows in the form of advance tax, GST and other statutory dues payable. This is also evident from the fact that other treasury products like arbitrage funds have also seen heavy outflows in the month of Sep-20. One unique trend during the month is that there has been a rush for floating rate funds. That can be explained by the fact that many treasurers are betting on the bond yields going up due to high levels of fiscal deficit. Otherwise, the outflows have been largely concentrated in the short duration debt funds only.

Passive comes of age

One big trend that got accentuated during Sep-20 was that passive funds ruled the roost. As a group, passive funds like index funds, index ETFs, gold ETFs, global FOFs and bond ETFs saw total inflows of Rs.6350 crore. Clearly, higher costs and steeper kurtosis is making life difficult for a lot of active managers. They are increasingly finding it hard to beat the indices. The big story in Sep-20 was the surge in demand for international FOFs. Surely, investors are now putting money where there is clear performance visibility; which is good!