Announcement: Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec et quam blandit odio sodales pharetra.

Interesting shifts are happening in mutual fund flows

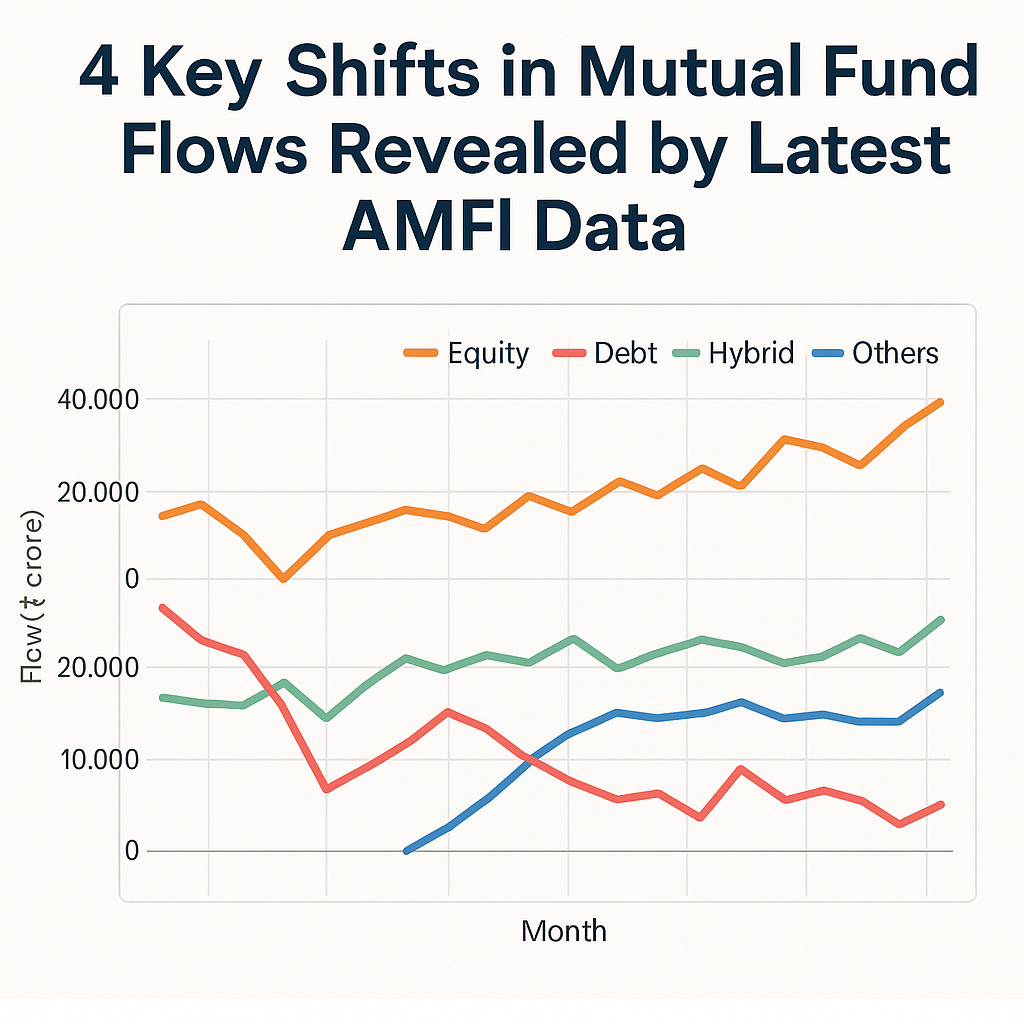

The monthly flow numbers for mutual funds put out by AMF in the previous week has some interesting insights. In fact, there are 4 key insights for mutual funds that emerge from flow numbers and they mark a shift in MF thinking.

Table of Content

Debt is now a treasury product

While debt will continue to be a key investment component, the role of debt funds is becoming more institutional and more of a treasury product. The flows into debt funds are getting cyclical and in the overall MF AUM of Rs.37.5 trillion, debt funds are consistently ceding their market share. This will be the trend in future with retail becoming a more dominant player in mutual fund AUM. The gap between debt fund share and equity fund share is at its lowest ever.

Equity flows are all about SIPs

For the second month in succession, the flows into systematic investment plans or SIPs stayed well above Rs.10,000 crore. At this run rate, the FY22 full year SIP collections are going to be the best by a margin. More importantly, the real story is in the way the SIP folios and the SIP AUM is building up. SIP folios are on target to touch 5 crore by Jan-22 and the SIP AUM is already at 42% of the total equity AUM and 35% of the overall retail AUM. Equity funds have got a big boost from the Nifty rally, but the real story is the emergence of SIPs as the engine of retail growth in equity funds.

Alternate asset classes emerge

For a long time, Indian mutual funds were all about equity and debt. Today, if you look at the AUM mix, the combined AUM of hybrid funds and passive funds are more than 25% and growing. In terms of monthly flows, specific classes like the Balanced Advantage Funds and PSU Debt ETFs have been contributing to a chunk of the mutual fund inflows in any particular month. With a new brand of young and upwardly mobile investor base, mutual funds are seeing greater demand for hybrid and passive ideas and that is good. It signals emergence of alternate investment options as the growth engine for mutual fund AUM.

Performance has been the key

For a long time, mutual funds were all about pedigree. Funds backed by global names or large Indian banks were the preferred choice. No longer. It is all about performance. For example, if you look at the bottom performers in terms of flows, you find formidable names like HDFC MF and Franklin Templeton in a large number of categories. Funds of the SBI family and even smaller fund houses like Mirae and NJ are getting flows purely on the strength of the performance and positioning. That is the new trend that is being seen in the nature of flows into specific funds. That is good as it makes the mutual fund segment more performance driven and less pedigree or parentage driven!

Comments