Announcement: Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec et quam blandit odio sodales pharetra.

Heavy FPI Selling Persists in Jan 2025 as $4.1 Billion Exits Indian Markets

NSDL data reveals FPIs dumped Indian equities worth $4.1 billion in the first half of Jan 2025, selling across 19 of 22 sectors. BFSI, Power, and Capital Goods bore the biggest brunt as global headwinds and weak earnings outlook kept foreign investors on the sidelines.

Table of Content

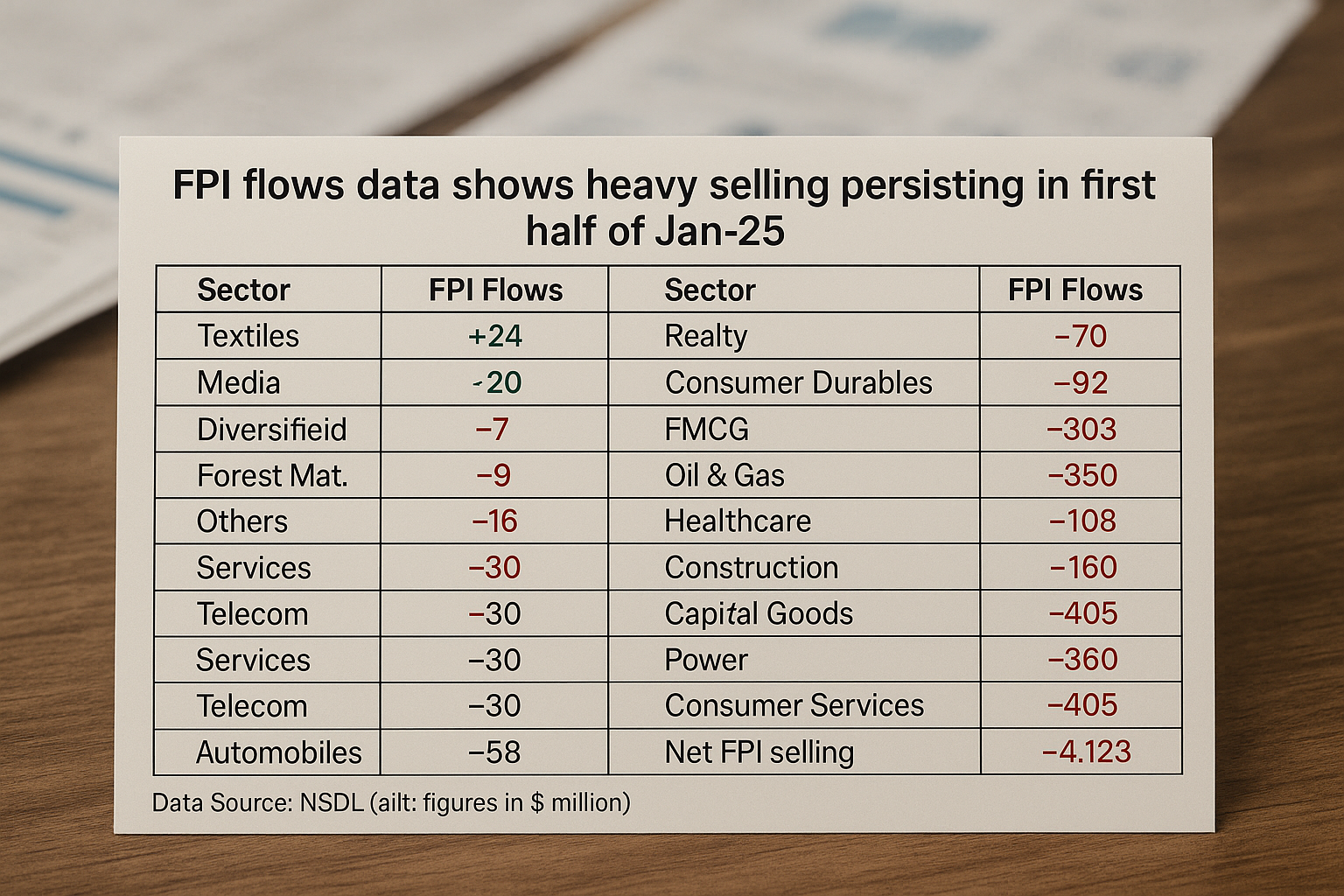

FPI flows data shows heavy selling persisting in first half of Jan-25

NSDL has reported the FPI flows numbers for the first half of January 2025. No prizes for guessing; FPIs have been net sellers to the tune of $4,123 million in the first 15 days of January 2025. Remember, the month has just begun and there is the second half of January still to traverse. Looking at current momentum, selling could only get sharper.

| Sector | FPI Flows | Sector | FPI Flows | Sector | FPI Flows |

| Textiles | +24 | Realty | -70 | Infotech | -223 |

| Media | +20 | Cement | -92 | Metals & Mining | -231 |

| Chemicals | +5 | Consumer Durables | -108 | Capital Goods | -303 |

| Diversified | -7 | FMCG | -131 | Power | -360 |

| Forest Material | -9 | Oil & Gas | -139 | Consumer Services | -405 |

| Others | -16 | Healthcare | -169 | Financial Services | -1,411 |

| Services | -30 | Construction | -188 | Net FPI selling | -4,123 |

| Telecom | -58 | Automobiles | -222 |

Data Source: NSDL (all figures in $ million)

What are the quick takeaways from the table above. Out of the 22 sectors that the NSDL offers a flow classification for, only 3 sectors saw positive FPI flows, and even in these cases, the amounts were not significant. The remaining 19 sectors saw negative FPI flows in the first half of January, resulting in net FPI outflows of $4,123 million. Out of the remaining 19 sectors, BFSI was the only sector to see outflows in excess of $1 billion, while another 6 sectors saw net FPI selling to the tune of over $200 million in the first half of the month. There does not appear to be any sectoral bias, as the selling by the foreign portfolio investors is virtually across the board.

For the FPIs, there are concerns in most sectors. In the case of the banking & financial services space, the concerns pertain to falling growth in the NII and narrowing NIMs. Already banks are struggling with high cost CD deposits to keep pace with loan growth. In the case of consumer services, the challenges are not only on demand, but also on the business profitability. That also applies to FMCG sector. Power and capital goods appear to have been hit by the slowdown in capex by the government while the metals & mining sector saw selling, more as an outcome of uncertainty over Chinese recovery.

No Respite From Fpi Selling Appears Likely In Jan-25

While it would be hard to predict when the FPIs will again turn net buyers, that does not appear likely in the short term. There are just too many short term headwinds like a weak Q3FY25 for Indian companies, sharp fall in the Indian rupee, oil prices rallying to above $80/bbl, and the Indian market Buffett ratio at above 140%. Under these circumstances, it is very unlikely that FPI flows would come back with a bang. The only exception, of course, is that the government announces a big bang budget on February 01, 2025. After all, this government has done best when it is in a tight corner!

Comments