Announcement: Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec et quam blandit odio sodales pharetra.

Government must avoid the temptation of selling it too cheap

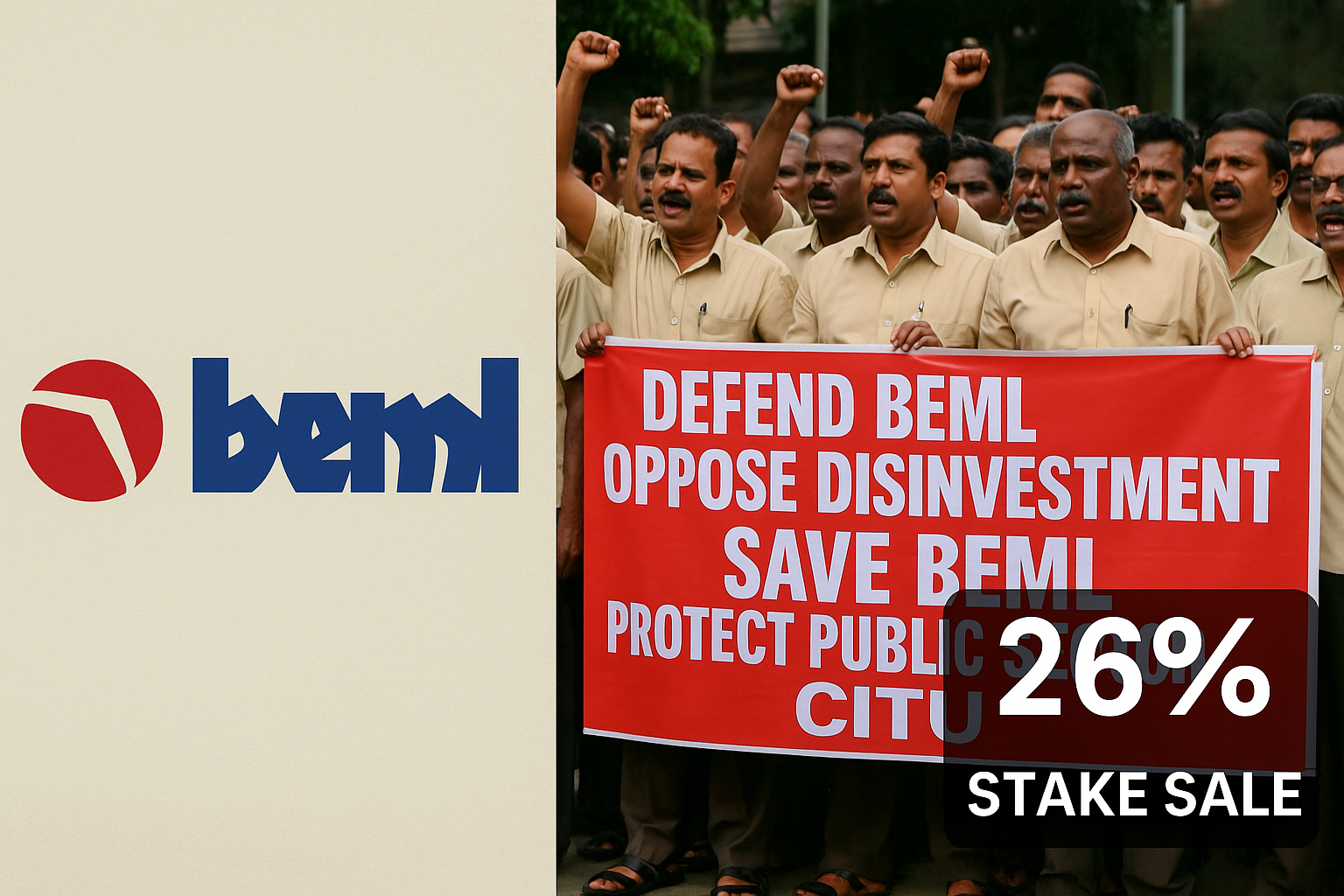

Over the last few months, the staff of BEML Kanjikode in Kerala have held a series of protests against the proposed divestment of BEML. The government plans to sell 26% stake to private firms and Tata Motors, Bharat Forge and ALL are among those shortlisted. The issue is about selling BEML too cheap?

Table of Content

Why sell a national asset cheap?

For a silent PSU performer, BEML is into the manufacture of a plethora of high-end products including military trucks, railway / metro coaches, Prithvi Missile launchers, earth movers, construction equipment etc. It currently operates via its 4 plants situated at Bengaluru, Kolar, Mysuru and Kanjikode in Kerala. The big worry for the BEML employees is that the government is just giving away a top-notch PSU player with a solid order book position for a song. Their concerns are not entirely unfounded. The total market cap of BEML currently stands at Rs.5,400 crore and 26% stake sell will fetch the government around Rs.1,400 crore. That is hardly going to make any serious difference to the total divestment target of Rs.175,000 crore. In fact, if you take the latest quarter EPS and annualized it and then calculate the P/E ratio, BEML is available at about 9X P/E. That is too low a valuation to divest a blue-chip defence manufacturer with an order book position of Rs.10,000 crore and expected to grow to around Rs.16,000 crore during this year.

Selling profitable companies

The issue is not just because it is a PSU divestment, but because it is actually a strategic sale, in which the government will end up becoming a minority holder in BEML. The government currently has 57% stake in BEML and post the sale it will be left with just 31% and will also lose the promoter tag. The contention of the BEML employees is that there is no pressing need to sell off a profit making BEML with a burgeoning order book. Also, BEML is likely to be one of the big beneficiaries as the government goes for more in-sourcing of defence orders. It is in this background that the stake sale in BEML looks like a giveaway.

What the must government do?

While it is true that the government has no business to be in business, it is not a great idea to sell a top-quality asset for a song. Even its contribution is going to be negligible to the divestment target. There are 3 options. Firstly, it can look to empower the managers and help them create a true-blue value stock. The second option is to look to monetize some of the order execution, without really losing control of the company. The last option is to adopt the Indian Railways model. While the Railways are still under government control, there have been bits and pieces of high value activities that have been hived off; like IRCTC for example. That is a better way than hiving off BEML for a song!

Comments