Announcement: Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec et quam blandit odio sodales pharetra.

Indian Bonds – Non-inclusion in Bloomberg Index will matter to flows

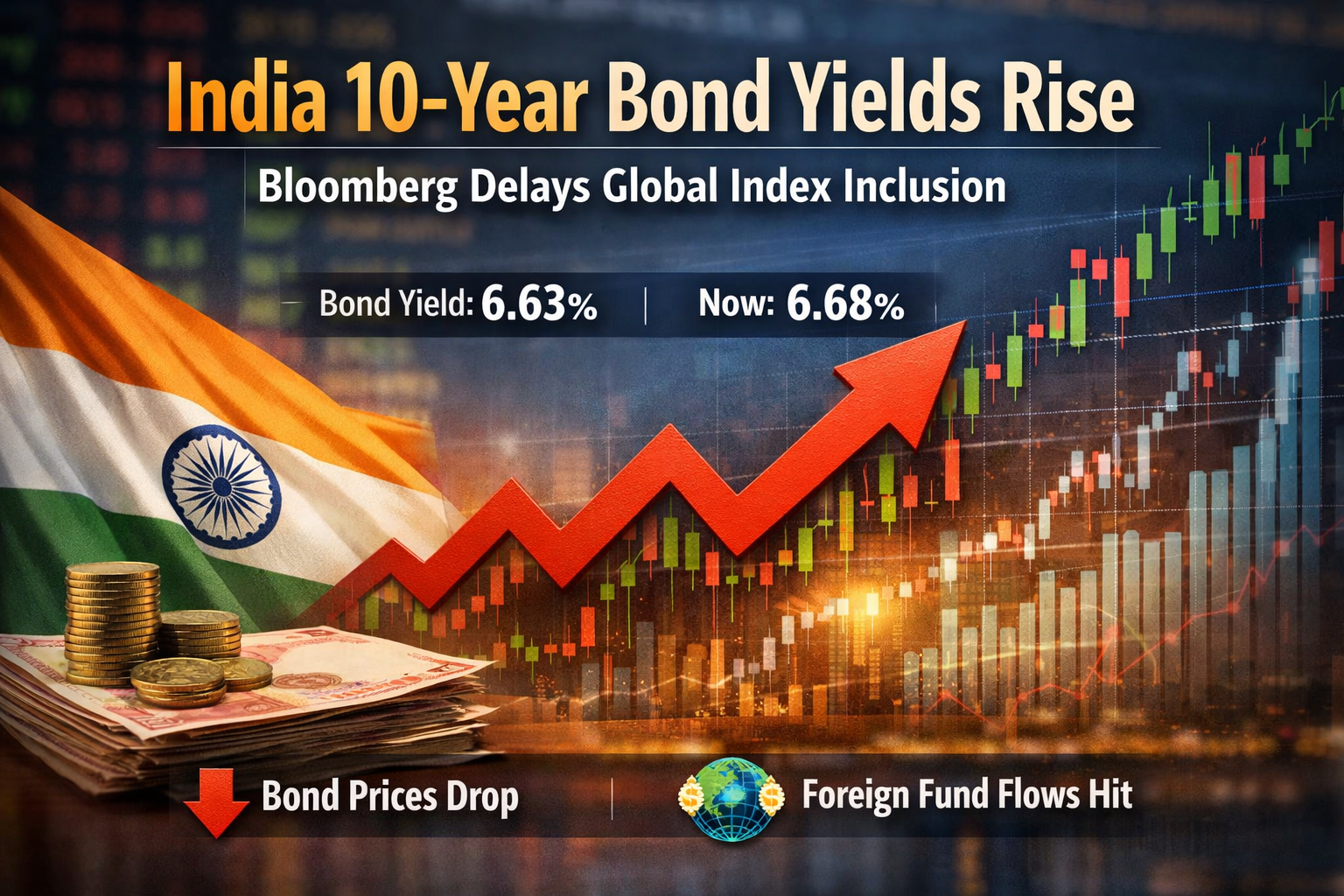

During the week, the 10-year bond yields in India spiked sharply from 6.63% to 6.68%, a move of 5 bps, which does not happen too often, The reason was a fall in bond prices after Bloomberg put off inclusion of Indian bonds in the Global Aggregate Bond Index.

Table of Content

Understanding the price yield linkages

It was a case of prices leading the yields higher. On 13-Jan, Bloomberg decided to put off the decision to include Indian bonds in the Bloomberg Global Aggregate Index (BGAI). We will come to the reasons later, but let us first look at the impact. Several bond traders had bought Indian bonds on expectations that they would be included in the BGAI. When Bloomberg announced its decision to put off inclusion of Indian bonds in its Global Index, there was a rush to sell these bonds, which led to a sharp fall in the price of these bonds. Since bond yields are inversely related to the bond prices, that led to a spike in the bond yields. This was more of a reaction and had little to do with yield expectations.

Why did Bloomberg put off the inclusion?

Before we get into the Bloomberg story, it is essential to understand that India is already a part of global bond indices of S&P, JP Morgan, and FTSE; three major providers of bond index services, other than Bloomberg. Even in the case of Bloomberg, Indian bonds are already a part of their Bloomberg Emerging Market (EM) Local Currency index. They have only deferred the inclusion in the Global Aggregate Index (BGAI). The reason offered by Bloomberg for this deferment is that they need to engage closely with bond market stake holders before making the final decision. At ₹120 trillion, the Indian bonds outstanding are much bigger than other countries already part of the BGAI.

What are the implications of this deferment?

One obvious outcome of this deferment is the flows into Indian bonds from global passive funds. Let us understand this. Global passive bond funds operate like passive equity funds; in that they invest in indices rather than in individual bonds. For that to happen, it is essential for the Indian bonds to be included in the major global bond indices. The inclusion in the Bloomberg Global Aggregate Index (BGAI) alone would have resulted in positive flows into Indian bonds to the tune of $20–25 billion. Now that money will continue to wait on the sidelines till the index inclusion actually happens. To that extent, the possible offsetting impact of FPI bond flows (amidst equity selling) will be impacted.

What initiatives are needed from the Indian side?

For the government, the inclusion would have been the much-needed boost ahead of the Union Budget on 01-February. Also, the steady flow of around $25 billion over the next 10 months would have helped stabilize the rupee well below the ₹90/$ mark. However, there are some significant inputs provided by Bloomberg on the reasons for non-inclusion. For instance, Bloomberg was unhappy with the market infrastructure. It also pointed to the lack of fully automated trading workflows, settlement and repatriation timelines, convoluted post-trade tax processes, and the duration of fund registrations. The sooner the government addresses these issues, the better it would be!

Comments