Announcement: Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec et quam blandit odio sodales pharetra.

As he steps down; his enduring legacy is much beyond returns

The two things that Warren Buffett would be best remembered for are the stellar returns generated by his fund and his annual letter to shareholders. However, his real legacy is much beyond that.

Table of Content

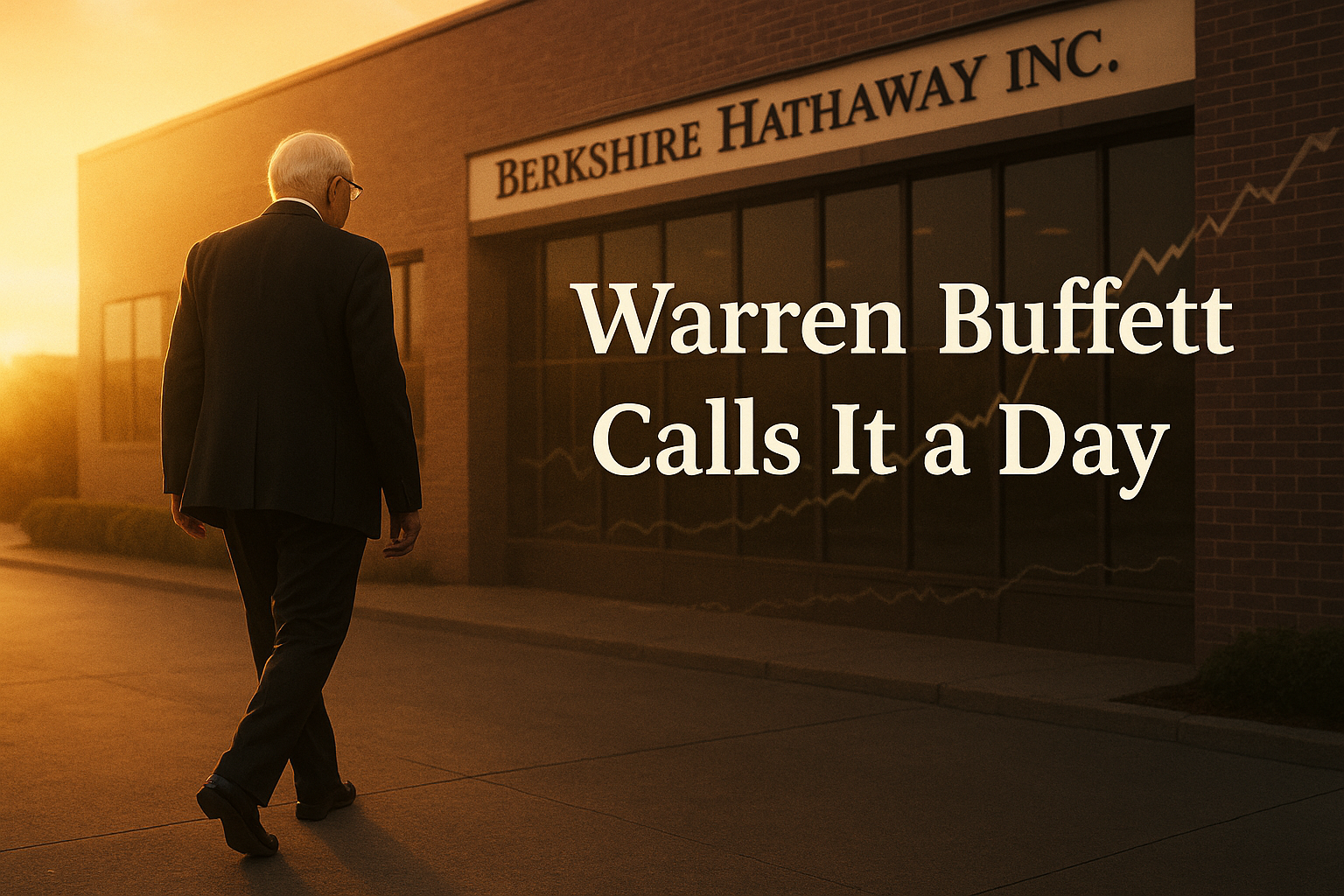

Buffett calls it a day

Warren Buffett has finally decided to call it a day at Berkshire Hathaway. As he hands over the reins to Greg Abel, he has promised that his role would be limited in the coming quarters. Buffett retires at the age of 95 and his long-time business partner, Charlie Munger, worked till his death in 2023 at the age of 99. With a cash stash of close to $382 billion, Greg Abel may have a bigger problem of how to deploy the money, but we will leave that for now. Let us look at two of his legacies he will be best remembered for; fund returns, and letter to shareholders

Why these are very different

Over the last 60 years, if the performance of Berkshire Hathaway was compared to the S&P 500, then the performance of Berkshire has been 2X. Such a massive outperformance in CAGR terms over 60 years is almost incredible. The other big legacy he will be best remembered for is his larger-than-life annual newsletters to shareholders. They were not just tomes on investment wisdom, but also a guide on how to invest pragmatically. Buffett lived by tenets of fundamental investing and that has stood the test of time. But there are 2 more aspects less-discussed.

Stick to your knitting

While moat-based investing and patience were the driving forces; one key reason for the stellar returns of Berkshire was his discipline with regard to the core focus. Buffett believed in simple businesses that generated profits on a sustainable basis. As he himself put it, “Select a business that even an idiot can run.” This explains why he never went into some of the big technology and green energy stories in the last 30 years. While Apple did make a bulk of Berkshire profits in the last few years, it is still a hardware company. When the tech bellwethers like Microsoft, Google, Amazon, and NVIDIA gave out amazing returns; Buffett neither opted to buy them; nor worried missing them out.

Just exit when you are wrong

It is not like Buffett has not made his share of mistakes. The good part; he has been quick to realize the errors in his assumptions and change strategy. He did buy stocks like the US airline stocks in the early part of this decade, expecting a major power shift happening. However, it did not materialize and he was quick to exit even at a loss. Same was the case with IBM, which was a tech stock that was already well beyond its prime. He did bet on its revival about 5 years back, but quickly realized that in the technology industry, it was very hard to regain the mojo you had lost. He has not only stuck to the winners, but exited losers. The result is there in the CAGR returns!

Comments